How to Make Your Rental Properties Stand Out From The Crowd And Lower Your Loss Factor

An assertion that many NYC landlords are lacking on the reputation front would hardly be breaking news. Some seem to have no interest in pleasing their tenants, building a sustainable (and growing) business, providing a quality product (housing) that keeps people coming back, and service (property management) that people are happy to continue to pay for. Of course there are also some landlords that have established a brand based on quality and reliability (the Related Group comes to mind). We at Village Confidential thought we would share a few of our thoughts with our landlord readers on how to get and keep quality tenants while protecting their asset and maximizing profit.

- Build and Promote a Community

- This concept works for large complex and brownstone multi-family properties alike. It’s all about building brand loyalty. People want to like where they live and this will give them a reason to be proud of it. Building a community will lead to fewer complaints, higher tenant retention, and more tenant referrals. There are a number of ways to go about doing this. Establish a sense of community with a monthly newsletter, electronic or on paper, to let them know what’s going on at the property (are you spending money to replace the boiler or paint the lobby?) or what’s going on in the neighborhood (did a great new restaurant open up down the street?). Encourage residents to contribute content, advertisements, or ideas to the newsletter. Sponsor mixers like a rooftop BBQ for the 4th of July or even drinks at a local bar for the Super Bowl. Co-brand your property while adding value for your tenants by encouraging the neighborhood’s favorite dining and nightlife spots to offer discounts or coupons directly to your tenants.

- Think About Your Pet Policy

- According to the U.S. Census Bureau, 42.1% of households with annual income over $85,000 own a pet. That’s quite a large section of the market to exclude from your pool of potential tenants. Of course, permitting pets in your building requires that you establish a well defined and transparent pet policy during the application process. Define the number of pets you will permit, the type, breed, size restrictions, and deposit requirements. Use a rider to your standard lease agreement to address issues such as complaints from neighbors and the replacement of pets that pass away (require notice). Anticipate the potential costs associated with permitting pets and pass that along to the tenant. Consider requiring a one-time or recurring pet fee (not a deposit) in consideration of allowing an animal in the apartment.

- Think About Your Smoking Policy

- One of the topics du jour in property management is whether to allow smoking in your building. Offering tenants a smoke free building can be a lucrative marketing technique. It attracts high-quality tenants who are willing to pay more for a smoke free building, it cuts down on move-out maintenance, reduces risks associated to fire, may lower your insurance costs, and reduces legal liability. There have been a number of high-profile cases in which tenants have asserted a breach of the Warranty of Habitability in relation to smoke related health issues in apartment buildings.

- Be Transparent With Security Deposits

- The security deposit should be used to cover damage caused by the tenant. Keeping deposits just to “see if the tenant will really pursue it” or overcharging for necessary maintenance and repairs will not promote a landlords reputation in the community. Real estate is a long-term business and reputation is important, especially in the Internet age. Make sure you or your broker are clear in your listings what the security deposit requirements will be. Take a quick video inventory of the unit just before possession is delivered to the tenant and keep the video on file until the tenant moves out. Have your broker or property manager use the video and post-tenancy examination of the property to determine what the tenant is responsible for. If the property is in need of repair, get written estimates for the cost and deduct it from the tenant’s security deposit, then promptly return the deposit to the tenant along with a written explanation of the deductions that were made.

- Avoid Tenancy Disputes and Holdovers

- Sixty days in advance of the termination of a tenancy, contact the tenant in writing and inquire about their intentions for renewal. Let them know what the renewal terms will be (rent, term, etc.). Insist that the tenant reply back to you in writing (and enforce this process with a provision in the original lease agreement). Document everything. Keep a simple spreadsheet of every communication you have with the tenant (i.e. called about water leak on 2/8, super fixed on 2/9, followed-up with tenant to confirm on 2/10). The same goes for rent collection and renewal communications.

- Be Uber-Responsive and Rule With an Iron Fist

- When tenants have complaints, they should be addressed immediately. Nothing makes a tenant unhappier than a non-responsive landlord. They start thinking about moving right then and there. Even if you can’t always accommodate a tenant’s request, get back to them within twenty-four hours. When appropriate, follow-up with them to make sure they were satisfied that a task was completed properly. Take these communications as an opportunity to ask the tenant their thoughts on the building and for information on anything that may need to be addressed. That being said, your tenants are not your friends. Set strict rules and regulations regarding the building and its living environment and enforce them. Good tenants prefer this because it means that they will have a more orderly living environment. Don’t allow severely delinquent rent payments to slide and don’t tolerate tenant behavior that make other tenants quiet enjoyment of the property suffer.

- Complete A Thorough Background Check and Use Stringent Application Requirements

- In order to establish the right tenant mix in your building, it’s important that you pay close attention to the application process. You should require the following from all tenants:

-

-

- Proof of income in excess of 40x the monthly rent (tax returns or cover in employment letter below if it’s a new position)

- Proof of liquid assets

- A prior landlord recommendation letter

- Proof of employment (signed by the employer)

- Current credit repot

- Housing court and criminal history pulled with credit

-

If the tenant cannot satisfy all of the requirements satisfactorily, consider allowing the use of a guarantor. Get the same documents from the guarantor that are noted above for the tenant (except that their annual income should exceed 80x the monthly rent). Your broker or property manager should be able to assist you with this process.

8. Stay on Top of the Current Market

-

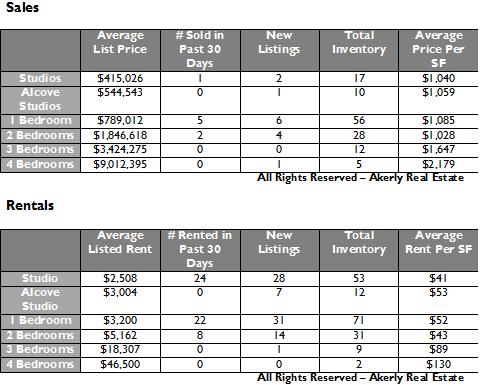

- It is vitally important that you price your multi-family property properly. If you price your apartments above current market values, you will lose existing tenants and increase your loss factor. Your vacancies will stay on the market longer, and you will gain a reputation in the brokerage community for overpricing (which decreases their interest in showing your properties). Are concessions such as free rent and O.P.s (owner pays the broker) typical for similarly situated apartments? Are the apartment’s renovations or the building’s amenities comparable to other listings at the same price in the neighborhood? Under pricing can also have severe consequences. For example, let’s say that you have ten apartments in one building asking $3,000 per month resulting in a $360,000 rent roll. If those ten apartments could have been rented easily for $3,200 per month (a 6.66% increase), you are losing $24,000 per year. If buildings in your neighborhood sell for a 5% cap rate, you have decreased the value of your building by $480,000 – all because you underestimated rental values by 6.66%. Make sure you or your broker are competent in pricing your apartment listings.

If you would like to speak to a member of our team about questions related to property management or brokerage of residential apartment rentals, please call us at (212) 400-4838 or e-mail us at keytothecity@akerlyre.com.